Combine Risk Management With Advisory Accounting for Business Success

A managerial accountant may identify the carrying cost of inventory, which is the amount of expense a company incurs to store unsold items. Accounting skills are important because they help businesses to manage cash flow, meet tax deadlines and set budgets for the year. Essentially, they help to understand the profitability of a company and its financial strengths and weaknesses. With such expertise, franchisees can manage their cash flow professionally, anticipate expenses, and enhance overall financial stability.

Learning Managerial Accounting With the CMA Credential

Hosting your accounting software within a V2 Cloud desktop environment provides a powerful solution for businesses seeking the flexibility of the cloud combined with the reliability and familiarity of a local desktop experience. Many cloud accounting platforms can integrate with other essential software, like CRM, payroll, and inventory management tools. Reputable cloud accounting providers ensure their software aligns with key accounting standards, such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

Importance of managerial accounting

Most accounting master’s programs feature core courses in accounting theory, internet technology, accounting analytics, and financial statement analysis. Management accounting concentrations include additional courses in controllership, internal and operational auditing, accounting and reporting issues, and advanced management accounting. The control function helps to determine the courses of action that are taken in the implementation of a plan by helping to define and administer the steps of the plan.

- Managerial accounting teams provide reports with recommendations that are critical in a business’s decision-making process.

- Cloud accounting solutions are regularly updated to comply with the latest tax laws and financial regulations, so businesses can manage finances confidently without worrying about outdated practices or compliance issues.

- Managerial accounting may define the pace and process of development of an organisation yet it has its set of drawbacks.

- These measures protect sensitive financial data and support compliance with industry regulations, allowing businesses to manage financial information confidently.

Helping Understand Performance Variances

With the shift to remote work and digital-first operations, traditional bookkeeping software often struggles to keep up. Risk management focuses on identifying, evaluating and addressing potential threats that could affect a company’s operations, profitability or reputation. Effective risk management anticipates these a complete guide to california payroll taxes threats and implements strategies to minimize their impact. This involves a structured internal audit approach to foresee potential issues and plan accordingly. The following overview explores degree options, career paths, curricula, and professional resources related to management accounting concentrations.

This is particularly true of upper-level management jobs or senior-level positions in a company like CFO or corporate controller. As part of your bachelor’s degree program, you may be required to complete an internship. Internships can provide invaluable experience that can enhance your resume and create professional connections. Even if not a requirement for your degree program, seek internship options if possible. Learn about managerial accounting the different types, careers, and how to enter this field.

Because it is located at the top of your CV, your personal profile gives you an opportunity to showcase the most relevant and important skills and quickly grab the recruiter’s attention. With that in mind, you should focus on highlighting your most impressive skills and achievements in this section. Your key skills section presents you with a chance to outline up to 10 of the most sought-after accounting skills.

This information plays a critical role in business decisions based on the company’s financial circumstances, forecasts and trends. Managers spend their time in various stages of planning, controlling, and evaluating. Generally, higher-level managers spend more time on planning, whereas lower-level managers spend more time on evaluating. At any level, managers work closely with the managerial accounting team to help in each of these stages. Managerial accountants help determine whether plans are measurable, what controls should be implemented to carry out a plan, and what are the proper means of evaluation of those controls.

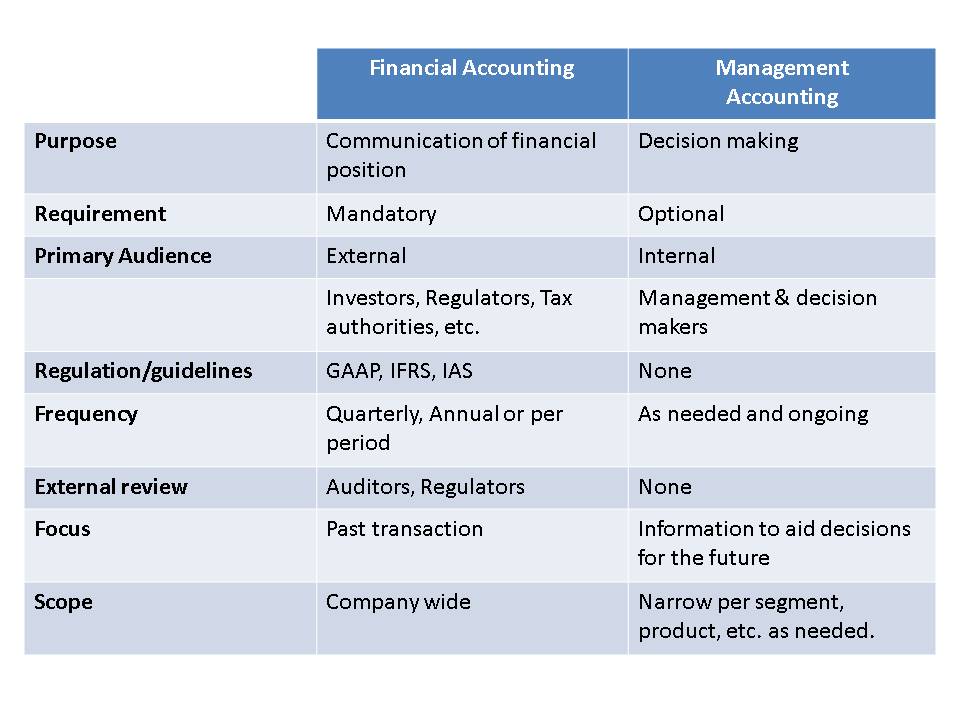

Managerial reports do not necessarily follow any particular format, but instead are uniquely designed to meet the needs of specific users. Analyses are often focused on targeted segments of a business rather than on a company as a whole. Information may be published over periodic time intervals or on an as- need basis. Managerial accounting involves not only actual financial data from past periods, but also current estimates and future projections. Financial accounting involves producing periodic reports called financial statements to inform such external groups as investors, boards of directors, creditors, and government/tax agencies about a company’s financial performance and status. The income statement, retained earnings statement, balance sheet, and statement of cash flows are published at fixed intervals to summarize the historical earnings performance and current financial position of a company.

Managerial accountants are the closest a company can get to hiring a fortune teller. Even a lower-level position in management can be a stepping stone to your dream role, from senior accountant all the way up to CFO. GPK is published in cost accounting textbooks, notably Flexible Plankostenrechnung und Deckungsbeitragsrechnung[19] and taught at German-speaking universities. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Coursera’s editorial team is comprised of highly experienced professional editors, writers, and fact…