Salvage Value Formula + Calculator

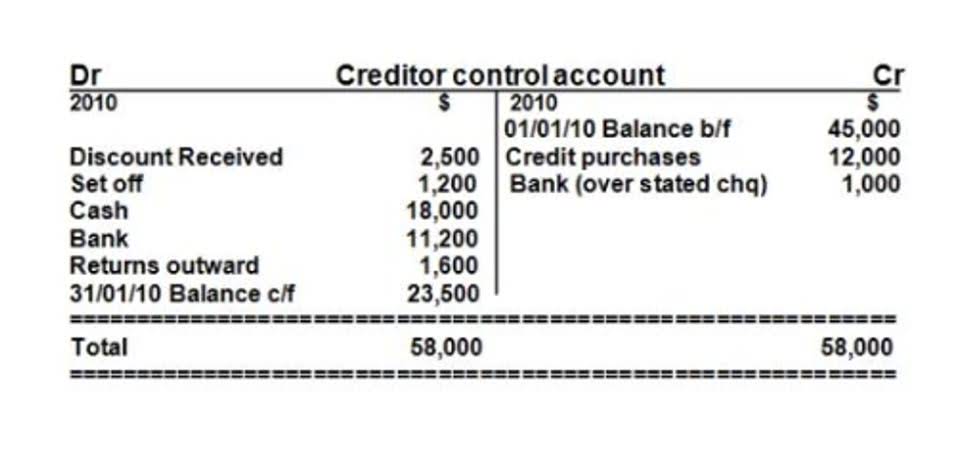

This valuation is determined by many factors, including https://x.com/BooksTimeInc the asset’s age, condition, rarity, obsolescence, wear and tear, and market demand. And the depreciation rate on which they will depreciate the asset would be 20%. To appropriately depreciate these assets, the company would depreciate the net of the cost and salvage value over the useful life of the assets.

Straight-Line Depreciation Method

- For example, a company may decide it wants to just scrap a company fleet vehicle for $1,000.

- Overall, the companies have to calculate the efficiency of the machine to maintain relevance in the market.

- On the other hand, salvage value is an appraised estimate used to factor how much depreciation to calculate.

- The difference between the asset purchase price and the salvage (residual) value is the total depreciable amount.

- Get instant access to video lessons taught by experienced investment bankers.

Sometimes scrap materials can be used as-is and other times they must be processed before they can be reused. An item’s scrap value—also called residual value, break-up value, or salvage value—is determined by the supply and demand for the materials it can be broken down into. To estimate salvage value, a company can use the percentage of the original cost method or get an independent appraisal. The percentage of cost method multiplies the original cost by the salvage value percentage. If your vehicle is totaled, the insurance company will assess its salvage value.

What Is the Loss for Tax Value?

You paid $10,000 for the fridge, $1,000 in sales tax, and $500 for installation. Say you’ve estimated your 2020 Hyundai Elantra to have a five-year useful life, the standard for cars. Take a look at similarly equipped 2015 Hyundai Elantras on the market and average the selling prices.

How do you determine the salvage value of a car?

Salvage value is also called scrap value and gives us the annual depreciation expense of a specific asset. It must be noted that the cost of the asset is recorded on the company’s balance sheet whereas the depreciation amount is recorded in the income statement. Most businesses opt for the straight-line method, which recognizes a uniform depreciation expense over the asset’s useful life. However, you may choose a depreciation method that roughly matches how the item loses value over time.

Formula and Calculating of Scrap Value

In some cases, salvage value may just be a value the company believes it can obtain by selling a depreciated, inoperable asset for parts. Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important component in the calculation of a depreciation schedule. Salvage value can sometimes be merely a best-guess estimate, or it may be specifically determined by a tax or regulatory agency, such as the Internal Revenue Service (IRS). The salvage value is used to calculate year-to-year depreciation amounts on tangible assets and the https://www.bookstime.com/ corresponding tax deductions that a company is allowed to take for the depreciation of such assets. Book value and salvage value are two different measures of value that have important differences.

How to determine an asset’s salvage value

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Suppose a company spent $1 how to get salvage value million purchasing machinery and tools, which are expected to be useful for five years and then be sold for $200k. The impact of the salvage (residual) value assumption on the annual depreciation of the asset is as follows. In order words, the salvage value is the remaining value of a fixed asset at the end of its useful life. Scrap value might be when a company breaks something down into its basic parts, like taking apart an old company car to sell the metal. If the salvage value is greater than the book value then income added after deducting the tax, the value/ amount then left is called after-tax salvage value.

How Salvage Value Is Used in Depreciation Calculations

Depending on the method of depreciation adopted by a company, such as the straight-line method or declining-balance method, the scrap value of an asset will vary. For example, consider the value of land owned by a company that only slightly went up in value by the end of its useful life. Companies can also use industry data or compare with similar existing assets to estimate salvage value. For example, a delivery company might look at the value of its old delivery trucks for guidance.

Understanding Straight Line Basis

A company can also use salvage value to anticipate cash flow and expected future proceeds. Yes, salvage value can be considered the selling price that a company can expect to receive for an asset at the end of its life. Therefore, the salvage value is simply the financial proceeds a company may expect to receive for an asset when it’s disposed of, though it may not factor in selling or disposal costs. There are several ways a company can estimate the salvage value of an asset. This method assumes that the salvage value is a percentage of the asset’s original cost.